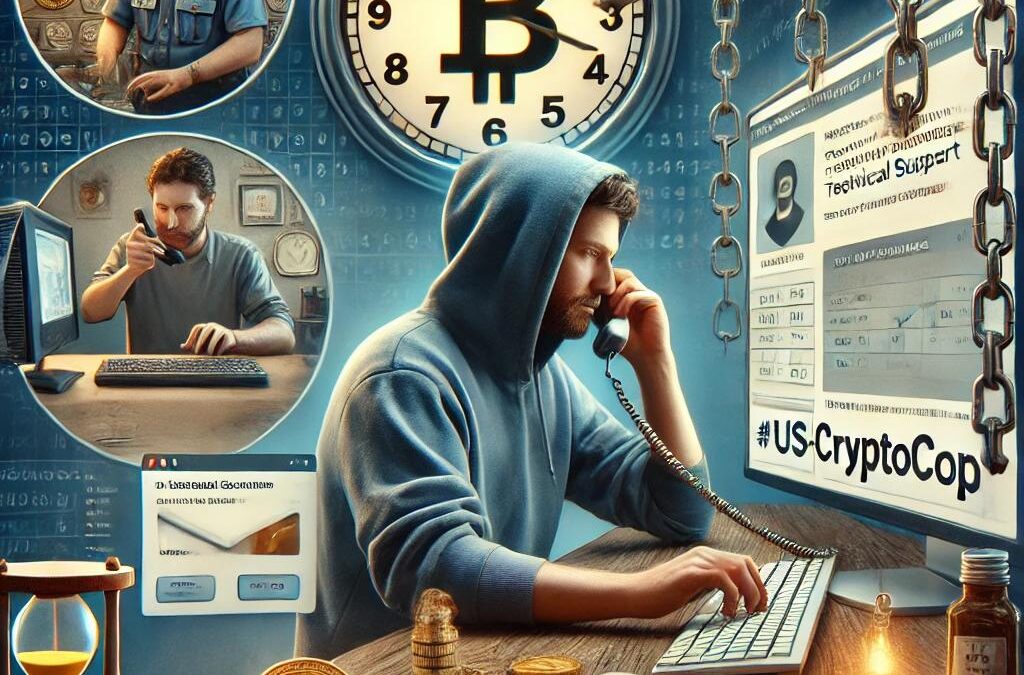

Cryptocurrency, often hailed as a groundbreaking innovation in finance, has brought new opportunities for cybercriminals to exploit unsuspecting victims. One of the most prevalent methods used by scammers is social engineering—a technique involving psychological manipulation to trick individuals into revealing confidential information or performing actions against their best interests. This article explores how crypto criminals, and scammers more broadly, use various social engineering tactics such as impersonation, phishing, vishing, and other manipulative schemes to deceive victims into handing over their private keys, financial information, or access to their wallets. The scammers create a heightened sense of urgency to pressure their victims into immediate action without careful consideration.

Understanding Social Engineering in Scams

Social engineering exploits human psychology rather than technical weaknesses. The hallmark of these scams is the creation of a false narrative that convinces victims to trust the scammer or act quickly out of fear. Whether in traditional banking, cryptocurrency, or family-related schemes, social engineering attackers use urgency, fear, trust, and curiosity to manipulate their victims. A common element across these schemes is a fabricated sense of urgency. Scammers know that when people believe they are facing an immediate threat or time-sensitive opportunity, they are more likely to make impulsive decisions. Victims are pushed to act before they can fully evaluate the situation or recognize warning signs. For instance, a cryptocurrency scammer might claim that a victim’s account is compromised, and that immediate action is required to prevent the loss of funds. This false urgency discourages the victim from taking the necessary time to verify the situation with the real organization.

Impersonation: Pretending to Be a Trusted Authority

One of the most common social engineering tactics is impersonation, where a scammer pretends to be a trusted authority figure, such as an IT support representative, bank employee, or law enforcement officer. This tactic is effective because individuals often feel pressured to comply with authority figures, especially when a sense of urgency is introduced. In cryptocurrency scams, criminals often pose as customer service representatives from well-known exchanges or wallet providers. The victim receives an urgent message or phone call, claiming their account has been hacked, and is urged to provide private keys or seed phrases immediately. In a panic, victims comply, allowing the scammer to drain their wallets within minutes.

This tactic is not limited to cryptocurrency scams. In traditional banking, criminals use similar impersonation tactics. One of the most well-known examples is the “child or grandchild in trouble” scam. In this scheme, scammers pose as a relative, usually calling an older victim and pretending to be their grandchild. They claim to be in urgent trouble—stuck in a foreign country, involved in an accident, or arrested—and need immediate financial assistance. The pressure is intensified with emotional pleas for help, urging the victim to act quickly without verifying the situation.

Phishing: Deceptive Emails and Websites

Phishing attacks are a classic form of social engineering in which scammers send fraudulent emails, texts, or social media messages designed to look like legitimate communications from trusted sources. These messages typically warn of urgent issues like compromised accounts or expiring subscriptions, prompting the victim to act fast by clicking a malicious link or providing login credentials. In cryptocurrency scams, the phishing emails often mimic well-known exchanges, asking victims to “secure” their accounts by logging in through a fraudulent link. Once they enter their information, the scammers can access the account and steal funds. This sense of urgency is key to phishing’s success. Victims believe they are preventing something bad from happening—such as losing funds or access to their accounts—and take action quickly, without questioning the authenticity of the message.

Beyond cryptocurrency, phishing scams are rampant in other areas. For example, tech support scams are a major issue. In these schemes, victims are contacted by phone or email, with scammers claiming to be from a well-known company like Microsoft. They warn the victim that their computer has been infected with malware and needs immediate repair. Often, the scammer requests remote access to the victim’s computer to “fix” the problem, which allows them to steal personal information, install malware, or demand payment for unnecessary services. These scams often involve a time-sensitive message, urging the victim to act now to prevent further damage.

Vishing: Voice-Based Social Engineering Attacks

Vishing, or voice phishing, is another social engineering tactic where scammers call victims pretending to be from a legitimate organization. Like other social engineering methods, vishing often creates a sense of urgency to prompt quick action. A common vishing scenario involves scammers posing as bank employees or cryptocurrency exchange representatives, warning victims that their accounts have been hacked. The scammers pressure the victims to provide sensitive information or passwords over the phone to “verify” their identity. In the context of cryptocurrency, a scammer might call and claim that the victim’s wallet is at risk due to suspicious transactions. The scammer insists that the victim needs to provide their private key immediately or risk losing their assets. The urgency of the message and the fear of losing their funds prompt the victim to comply without thinking carefully.

Vishing scams are not limited to financial fraud. In tech support vishing scams, the fraudster often impersonates a technical support specialist, claiming to have detected viruses or security threats on the victim’s device. The caller then pressures the victim into granting remote access to their computer, offering to “fix” the problem. Once inside the computer, the scammer can steal sensitive information or demand payment for fraudulent services.

Baiting: Exploiting Human Curiosity

Baiting is a form of social engineering that lures victims with promises of something attractive or interesting—like free cryptocurrency, software, or downloads. In cryptocurrency scams, baiting might involve promises of a reward or an enticing new investment opportunity, but only if the victim provides sensitive information or access to their wallet. The urgency often comes in the form of time-limited offers or exclusive opportunities, tricking victims into acting without verifying the legitimacy of the offer. Baiting tactics can also appear outside the crypto space. For instance, scammers may distribute malware-infected USB drives labeled with intriguing titles like “Confidential” or “Salary Information.” The drive is deliberately left in a public area, such as a parking lot, with the hope that someone will find it and connect it to their computer, unknowingly infecting their system.

Pretexting: Creating a False Narrative

Pretexting involves creating a fictitious scenario to convince the victim to provide sensitive information. Scammers fabricate stories, sometimes using highly convincing details, to make their request seem legitimate. A common pretexting tactic in cryptocurrency scams is when the scammer poses as a tax official, claiming the victim owes taxes on their crypto holdings. To resolve the issue, the victim is asked to provide wallet information or payment in cryptocurrency. The urgency of the tax claim and the fear of legal consequences lead many victims to act before verifying the scammer’s credentials. In non-crypto-related scams, pretexting is often seen in the “child/grandchild in trouble” scams, where the scammer calls posing as a relative in urgent need of money. By creating a highly emotional and time-sensitive situation, scammers push victims to send money immediately, often through untraceable methods like wire transfers or prepaid cards.

Protecting Against Social Engineering Attacks

The key to defending against social engineering scams is awareness and skepticism, especially when faced with urgent requests for sensitive information or quick decisions. Whether the attack targets cryptocurrency or more traditional financial systems, vigilance is essential.

Some best practices for protecting against social engineering attacks include:

- Pause and think before acting: Scammers rely on urgency to prevent victims from thinking critically. Always take a moment to verify the information, even when the request feels urgent.

- Never share private keys or sensitive information: Legitimate organizations will never ask for private keys, passwords, or personal identification numbers.

- Use multi-factor authentication (MFA): Implementing MFA adds an extra layer of security by requiring additional verification steps, even if login credentials are compromised.

- Contact the organization directly: If you receive a suspicious email or call, contact the organization through official channels to verify the authenticity of the message.

- Be cautious of unsolicited communications: Whether it’s an email about a compromised account or a phone call from a “tech support” specialist, always be skeptical of unsolicited requests for sensitive information.

Social engineering attacks, especially those exploiting urgency, are among the most effective techniques scammers use in the cryptocurrency world and beyond. Whether through impersonation, phishing, vishing, or emotional manipulation, scammers prey on the instinct to act quickly under pressure. Understanding these tactics and taking time to verify suspicious requests are essential steps in preventing victimization. By recognizing the art of deception and staying informed, individuals can better protect themselves from these manipulative scams.

For more resources and information to protect yourself against scams, visit https://www.uscryptocop.com.

#USCryptoCop